MANADATORY DISCLAIMER: I am not a tax professional. Use, and any continued reading of this article, you accept that the information contained offers no judgment of any particular tax situation, is merely reportorial, and that it is highly advised to consult a tax professional before doing anything that could have any kind of tax consequences. This article is not intended to constitute tax advice. You accept all responsibility and risk associated with your usage of any piece of information contained on this website. UPDATE: @ approximately 6PM EST 03/11/2023, a representative from TurboTax contacted me, and confirmed the glitch. They are escalating further, with no further updates at this time. As of March 10th 2022, there is an ongoing glitch in the turbo tax software, which may result in receiving less than your entitled refund. I found, tested, and proved the glitch to Turbo Tax Customer service, who refused to forward it to their engineers. The problem appears to happen exclusively when the app calculates your medical expense refund entitlement. Having myself claimed the medical expense supplement in multiple years (and having genuine OCD), when I went to file a return for a family member, I knew there was supposed to be a positive value on line 45200, which Turbo Tax correctly labels the "Refundable medical expense supplement" on the Deductions Summary. However after doing the return, it was showing zero. There are obviously specific criteria to be met to qualify, and I even brought up the official CRA 2022 Federal Worksheet and demonstrated the calculation there showed a positive value. There are no software updates available at this time to patch this glitch either.

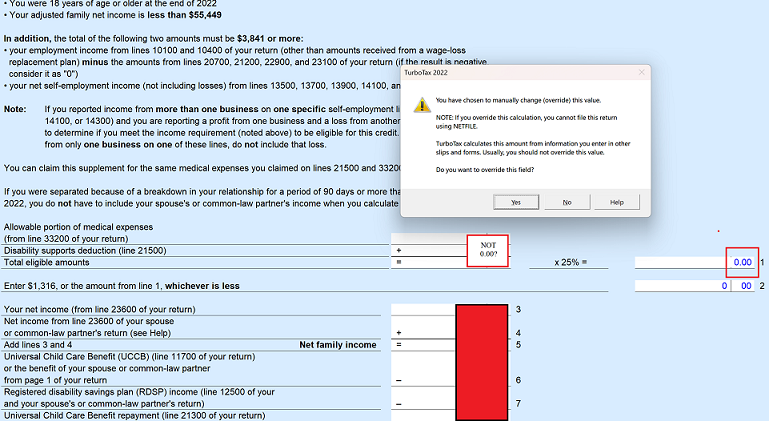

The Problem: Unfortunately there's a mismatch in the amount of the Medical Expense Supplement Turbo Tax provides. This is not a problem that a consumer using the typical "EasyStep Interview" could accidentally be the legitimate cause of without doing a manual/advanced return or omitting their medical expenses entirely. After doing some digging with their customer service, who coordinated with a 'supervisor', we found the problem. Apparently the Refundable Medical Expense Supplement Form in the TurboTax PC app, actually outputs any positive amount on line 45200 as zero. The reason for this is TurboTax seems to multiply the sum of line 33200 + line 21500 as always zero, despite starting with a positive number. Below is how you can see if you're affected and how to remedy the situation if it happens to you.

1)

2) 3) *If you aren't as comfortable with tax forms, skip to 4* If you see a positive number on Allowable Medical Expenses but not on Refundable Medical Expense Supplement, you can go to the Federal Worksheet to check your eligibility yourself. Near the end will be Line 45200 to calculate if you're eligible for the credit. If after that you have anything other than zero on Line 21 (where it says "Enter this amount on line 45200 of your return.") then you are likely experiencing the glitch.

4) Lastly, this is how you can check in TurboTax and fix it! Click the large "Forms" button at the top right. In the very bottom left corner you will see 3 small buttons. One is your name or the name of a person you are filing for, one is the Forms button, and one is the T-Slips button. Click Forms, and then from the pop-up, click Form Lookup. Type "Refundable" in the Keyword to Search for. When Matching Keywords comes up with "Refundable Medical Credit", click on that and click OK. Now look at the line that says "Total eligible amounts". Is there any number other than zero here? And if so does this number multiplied by 25% mysteriously equal zero? Then you absolutely encountered the glitch! Now the unfortunate part: To fix it, you actually are forced to give up your ability to Netfile. But at least there is a fix so you don't lose out on some/all of your refund.

I highly recommend saving your return before proceeding.

2022 Turbo Tax Refund Glitch & Workaround

🤔 Am I affected? 🤔

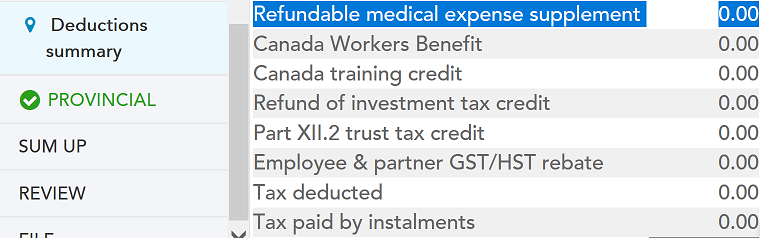

First, go to your Deductions Summary Page. Does it have a value here? If you have any number other than zero, then your software is likely working as intended and you are probably not experiencing the glitch. (Cropped/Condensed for space)

First, go to your Deductions Summary Page. Does it have a value here? If you have any number other than zero, then your software is likely working as intended and you are probably not experiencing the glitch. (Cropped/Condensed for space)

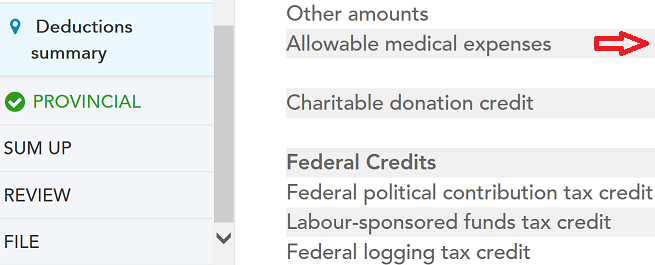

Do you have a positive amount on the "Allowable medical expenses" line? If not, you either are not eligible (for example, because your income is too high), or you did not enter sufficient expenses earlier in the app. In order to have a positive number on this line, you need to have total eligible medical expenses above 3% of your income in addition to other criteria (see the Federal Income Tax and Benefit Guide for details). If you don't have anything on this line, you are also likely not experiencing the glitch.

Do you have a positive amount on the "Allowable medical expenses" line? If not, you either are not eligible (for example, because your income is too high), or you did not enter sufficient expenses earlier in the app. In order to have a positive number on this line, you need to have total eligible medical expenses above 3% of your income in addition to other criteria (see the Federal Income Tax and Benefit Guide for details). If you don't have anything on this line, you are also likely not experiencing the glitch.

🙂 The Easy Fix 🙂